Vertiv, which I already hold, has shown a promising 16% gain in the last week.

FuboTV (FUBO) is at last looking better with a 12% gain in the last week (24% in last 3 months).

Robinhood (HOOD) is looking strong but needs to be watched closely today as Q2 results are due at the end of today! 400% gain in a year with reasonably steady chart line.

Fortinet (FTNT) has been stable for 3 months but may jump up depending on Q2 results next Wednesday 6th Aug.

HIMS is rising rapidly as good expected Q2 results on 4th August are anticipated.

IUCM S&P 500 Communications has Meta, Netflix, Alphabet, Disney and telco companies as major holdings is one of my favourite ETFs (I pair with XLKQ) and has not performed as well in the last 6 months as it had the previous 6 months. I have topped up on this $ ETF in the hope of good Q2 results.

AMZN dived in the first 3 months of 2025 due to heavy capital investment and the weakened $, but it now looks to be making a strong recovery.

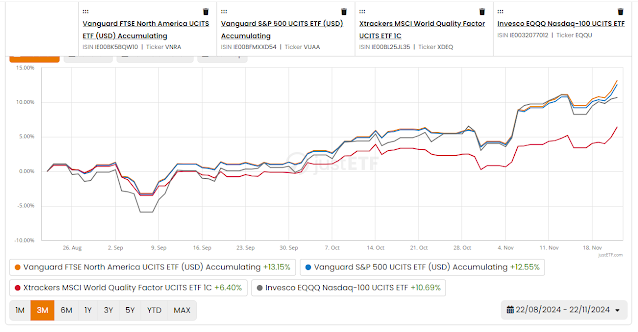

Classic high flyers PLTR, AMD, NVDA, MSFT, GOOG are being tipped this week, but I prefer to buy via index ETFs such as Nasdaq EQGB or EQQQ and S&P 500 Tech ETFs, etc.

XLKQ/IITU USA Tech and Nasdaq have performed well in last 3 months.

Note: This is not investment advice - i'm just an average bod on the internet!