Amazon does not feature much in high-performance Tech and Comms ETFs such as IITU or IUCM and comprises only 5% within the Nasdaq EQQQ ETF.

Some Consumer Discretionary ETFs hold a large proportion of Amazon (30%) and also Tesla (15%) such as XUCD (or XSCD for GBP). If you think Amazon and Tesla will do well next year when Trump takes over, this may continue to show good gains. I think Amazon will continue to show good performance next year although import tariffs and tightening advertising regulations in the EU and UK may adversely affect the Amazon online retail business.

Note: The ETF IUCD is very similar to XUCD and is available on Trading 212.

|

| Consumer Discretionary (blue) has shown good gains recently, mainly due to Tesla (and Amazon). |

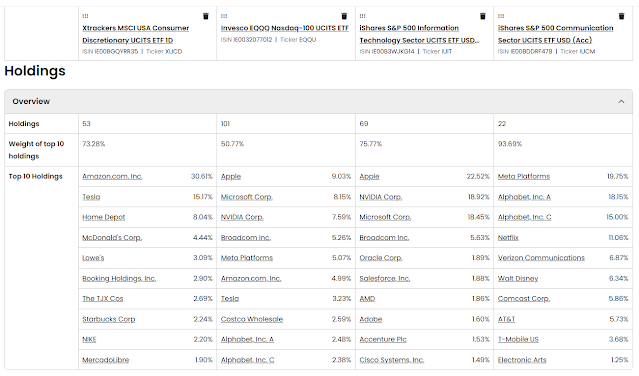

Compare holdings:

EQQQ is a compromise, but as there is not too much overlap between XUCD and my two favourite top Tech S&P 500 ETFs IITU (60% in Apple, NVidia, Microsoft) and IUCM (30% Alphabet A+C) you could also add XUCD or IUCD to these two Tech ETFs - see below.

|

| IITU and IUCM (last two columns) show little overlap with each other or XUCD. |

You can change the ratio of your IITU, IUCM and XUCD ETFs by buying more of the ones you favour if you Dollar Cost Average each month. This gives you more control than simply buying the S&P 500 or Nasdaq.

The Invesco US Technology Sector UCITS ETF seeks to track the S&P Select Sector Capped 20% Technology index. The S&P Select Sector Capped 20% Technology index tracks the technology sector of the USA. Single stocks are limited to a maximum of 20%.The ETF's TER (total expense ratio) amounts to 0.14% p.a.. The Invesco US Technology Sector UCITS ETF is the only ETF that tracks the S&P Select Sector Capped 20% Technology index. The ETF replicates the performance of the underlying index synthetically with a swap. The dividends in the ETF are accumulated and reinvested in the ETF.The Invesco US Technology Sector UCITS ETF is a very large ETF with 1,038m GBP assets under management. The ETF was launched on 16 December 2009 and is domiciled in Ireland.

Combine IITU+IUCM+XUCD ETFs

|

| 35+% gains in a year and hardly any overlap - what's not to like! |

IUCD is available on Trading 212 and is equivalent to XUCD.

No comments:

Post a Comment