Raindrops on roses and whiskers on kittens

Bright copper kettles and warm woolen mittens

Brown paper packages tied up with strings

These are a few of my favorite

things[ETFs]

I do use a small part of my investment portfolio to buy individual company stocks like NVidia or Amazon or Tower Resources (big fail!), but as I am no expert in company analysis, I tend to only break even with these at the best of times! The problem is always when one stock dives significantly - I have learnt that slow and steady is better than risking any significant loss in just one stock as it takes ages to recover from that loss.

Index ETFs on the other hand will never go down to zero and usually tend to go up or at least keep pace with inflation.

The only exception is if I (stupidly) buy a very risky stock. In this case, I will buy it inside my GIA account so that if I make a loss, I can deduct that loss from my total gains and thus pay less CGT. If it makes a large gain, then I don't mind paying the CGT! On the other hand, if I held it inside my ISA and I lost 90% of it, I cannot even make use of that loss and it will take months to get that money back from my other investments. Trading outside of an ISA does sometimes have an advantage in that you can deduct that loss from your gains.

The ETFs I have listed below are my current favourites.

My ratio of holdings in these however will vary depending on the current stock market climate.

|

| My favourite ETFs, ordered by fund size. |

I tend to not sell ETFs such as SWDA, XDEQ, XLKQ, HMWS, CSP1 and EQQQ, and so I hold these in my SIPP and GIA accounts and don't sell them so as not to incur capital gains tax.

The other ETFs in the list are factor ETFs which I may sell or buy according to the current market conditions and I try to hold these inside my ISA so that I do not incur Capital Gains tax if and when I sell them in order to buy something else.

You will see that over the last year, surprisingly, IUCD\ICDU (Consumer Discretionary - Amazon, Tesla, etc.) tops the list at 40% (above Tech, S&P 500, the NASDAQ and Gold). IUCD currently has a large holding in Amazon (31%) and Tesla(18%).

IUCD (aka ICDU for GBP version)

Due to this ETF having a 18.5% holding in Tesla, I am now (2025) very cautious of this ETF as Tesla is heavily reliant on US government subsidies (which Trump may rug-pull) and the selling of it's carbon credits to ICE car companies. I still like Amazon however.

Consumer S&P 500 top holdings (Amazon and Tesla, etc.)...

|

| IUCD - Consumer Discretionary top holdings |

Mainly Apple, NVidia and Microsoft...

I would prefer this to be not quite so heavily weighted in Apple at the moment.

Note: XLKQ is an equivalent synthetic fund with about 20% in each of Apple, Nvidia and Microsoft and so is slightly less top heavy into Apple than IITU but has shown slightly better historical returns that IITU.

|

| IITU Top ten holdings |

IUCM

Then we have IUCM (Google 31%, Meta 17%, Netflix 14%)...

|

| IUCM - Communications top holdings |

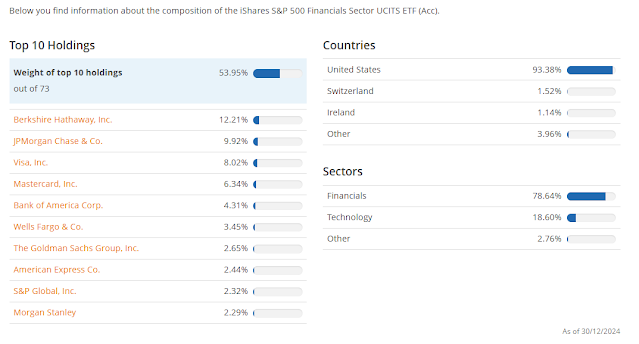

IUFS (USD)/UIFS (GBP) Financials is always a steady ETF too..

Because they are such large companies, they also top the SWDA global index tracker ETF too (approx 25%).

My favourite ETFs for today

Let's order them for gains in the last 3 months...- $IUCM mainly Google, Meta and Netflix

- £IITU mainly Apple, NVidia and Microsoft

- £UIFS/$IUFS Finance (top holding Berkshire Hathaway which I think is great for 2025)

and perhaps these if good value (buy on dip)... - £ICDU/$IUCD mainly Amazon (OK) and Tesla (overvalued?)

- £IUSU Utilities Energy, etc. (buy on dip)

Long Term 2-ETF Portfolio

- SWDA or HMWS (slightly cheaper TER) - World Index tracker (suggest 70%)

- XLKQ - S&P 500 Tech stocks capped @20% selected (suggest 30%)

XLKQ has shown 200% growth in 5 years while SWDA Global has shown 90% growth and that includes Covid in 2020 and the correction in 2022. XXTW would be a more diverse, global world alternative (less reliant on USA).

Tax matters!

- Personal Savings allowance £1000 (= £20k at 5%)

- Dividend allowance £500 (= £20k at 5% or 40k at 2.5%)

- Capital Gains allowance £3000 (= £15k at 20%)

No comments:

Post a Comment