This article will be updated regularly. Visit every week for updates. Bookmark it now!

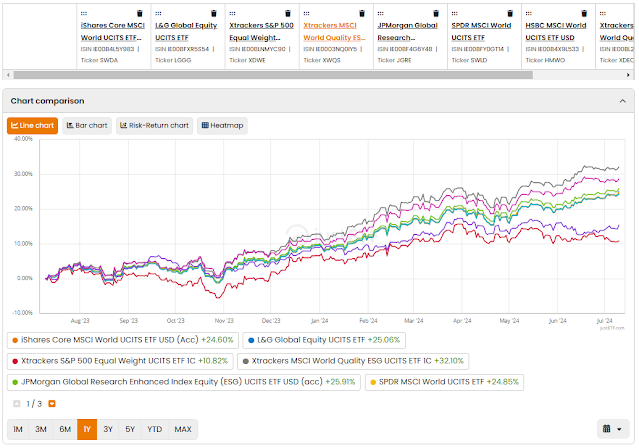

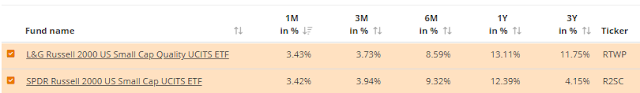

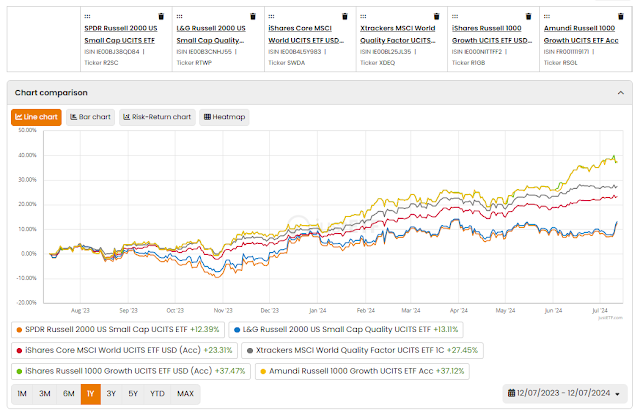

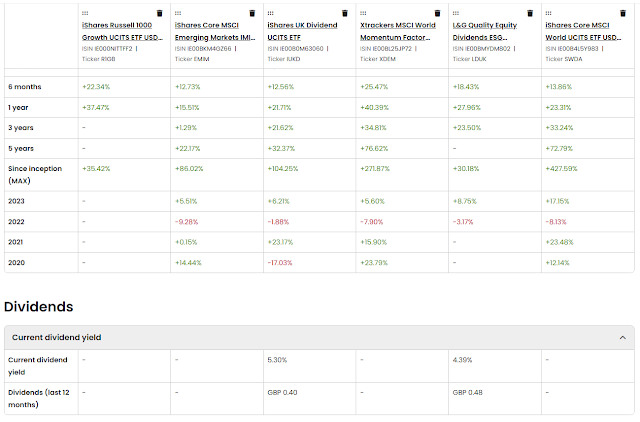

Charts/Info correct at 11 July 2024 (Justetf.com comparisons).

Updates

Blog page updated 15/7/24

Update 26/7/24 - Current Tech stocks correction, but 2024 Q4 S&P500 expected to do well in Q4. Wait for stocks to start rise again (may start today 26/7) and then BUY. May want to sell some in Q1 2025 if USA market volatile and buy more quality or world emerging market and small cap?

Update 5/8/2024 - Markets down 2-10% !! Mainly affected by USA - Fed failing to reduce interest rates and higher unemployment. Mostly however, companies are doing OK and the US market should recover after September. Probably too late to sell now, but get cash ready to invest in late Aug/Sept as soon as stocks start to plateau. UK\EU may be good as a hedge. Could consider selling some stock and buying CSH2 (money market 5.4%) but may miss recovery! I am not selling as expect bounce up when Fed finally cuts interest rate in Sept.

Update 13/8/2024 - Markets recovering to previous 3 months level. Market expecting Fed interest rate cut in Sept and better USA employment figures. If stocks dip today/tomorrow, maybe I will buy more.

Update 14/8/2024 - Best performing ETFs YearToDate, UICM 19% (US Comms), PQVG 21% (S&P QVM), IWFM 20% (World momentum), XDEM 20% (world momentum), IITU 22% (US Tech), XLKQ 25% (US Tech).

Update 16/8/2024 - Market recovered. Hot Tip: Buy TSLA now using ETF ICDU (Amazon 34%, Tesla 13%, Home Depot 8%). These companies may benefit from AI and also TSLA from sale of it's non-Chinese car software to all other global car companies that currently use Chinese OTA update software. Timeframe: 1 yr. BT group, Amazon, Alphabet and MSFT looking like strong buy (most except BT already in XLKQ ETF).

2024/8/27 - I bought FLXX sold some EMIM iShares Edge MSCI EM Value and all Japan.

Update 13/9/2024 - Market dipped but now recovering again! ICDU tipped last month is up almost 6% in one month. new tips are energy and finance sectors - e.g. IESU and IUFS for Mastercard\Visa. These are expected to do well within a 6 month time frame. For steady UK dividend stock try IUKD (5.8% in 3 months, 17% in 1 yr) which has beaten SWDA\XDEQ in last 1,3,6,12 months! Gold SGLN at all-time high, not a good time to buy - hold. I bought XLKQ 2024/9/4, XDEQ, SGLN and EQQQ 2024/9/10, IESU and IUFS 2024/9/13.

Update 21/9/2024 - Fed 0.5% rate cut happened which gave approx 1% rise to S&P. Smaller companies should now begin to do better as they will pay less interest on borrowings and can expand. The S&P600/small cap is a good bet now - e.g. ISP6 (2 divs/yr) or USSC (acc - heavier in financials which is good) or both as their top 10 don't overlap. Also Financials (WFEG or XLFQ or UIFS) and Energy (IESU - long term) seem good value.

Weekend rule (experimental)

- If shares drop late Friday, sell, bad news will come out over weekend and stocks will drop on Monday. Maybe!

Action: Set Change Alerts on stocks of say of 1% drop within an hour - pay attention to any changes late Friday.

Invest in:

Tech - IITU and IUCM in tech trending market, or R1GB Russell 1000, XSTC OR ---

XLKQ S&P Select synthetic slightly better.

XLKQ Top stocks exposure (%) Name Weight MICROSOFT 19.40 APPLE 19.00 NVIDIA 18.00 BROADCOM 5.60 AMD 2.10 SALESFORCE 2.00 ADOBE 2.00 ORACLE 1.80 QUALCOMM 1.80 APPLIED MATERIAL 1.60 Source: Invesco, as at 30 Jun 2024

XDEQ or XWQS (ESG) or 5ESG (ESG) for general global ETF good performance - or PQVG

Suggested portfolio (2024): Core portfolio could be XDEQ (world quality) + XLKQ (US Tech) (60-100%). Optional Satellites (0-40%) could be XDEV (world value), EMVL (emerging value), XUFB (banks), Energy (MLPQ). Hedge using SGLN (gold) or CSH2 (money market 5%) or bonds.

For UK investors, use IUKD when USA\Tech stocks not peforming (IUKD is financial, utility, retail but no tech.). Should do well with lower interest rates but Oct budget may have an affect! Has beaten SWDA over last year (inc. 5% dividends).

Buy Japan ETF IJPH if USA has poor performance or for USA hedge - maybe also buy FTSE EU non-UK?

If Tech slides, switch from USA Tech to World Quality XDEQ, Energy (MLPQ for acc. or MLPP for dist. ?) and value stocks (XDEV).

Market too choppy/volatile esp. Tech?

Consider SCHD (US investors) or UK IUKD or USA centric HDLG (UK Div) or DHSP (UK acc) for good quality dividend paying companies. HDLG has returned 13% in last 6 months.

How to 'Dollar Cost Average' (DCA) and feel good about market corrections!

1. Ensure all your monthly debts are settled, inc credit cards, mortgage, loans, etc,

2. Set up a monthly automatic transfer to your investment account so it is automatically invested in ETFs (e.g. a 'pie' on ISA Trading 212). I suggest 5% of your income or more every pay day.

3. Set up another monthly automatic transfer for the same amount again to an instant access savings account (or Trading 212 cash account which currently pays 5.2%). This money is a pot for investment only but is not yet invested - it is held as cash (or you could use it to buy a money market ETF such as CSH2 which pays 5% currently).

4. Sometime in the future there will be a temporary market correction (-10%) or recession (-20%) every 6-18 months. When the value of your portfolio drops, but BEFORE waiting for the very bottom, use half of this reserved cash to buy more stock/equity ETFs at a lower price (e.g. as soon as it is down 10%). Then, when the market appears to be just recovering or is even lower, buy more stock/equity ETFs with the remaining half of the spare cash. This is a way of taking advantage of the dips but also means that even though your equity portfolio has dived, the dips don't hurt you as much because you are buying at a cheaper price than you would if you had just used DCA each month. It also means you are not tempted to sell at a bad time. If there is no correction within 6 months and there is no talk of corrections, you can double the DCA amount for a month or two or just wait longer as corrections always come eventually! This strategy may not always be as successful as just DCA'ing each month but psychologically you will feel better and not be tempted to sell!

Below are some top UK registered ETFs which are good performers this year for their class...

ETFs

Global ETFs

SWDA - MSCI standard world tracker (benchmark in all comparisons below) - LGGG is a slightly better performed as has a bit more Tech sector and lower TER (0.1%) - HMWD is equiv but Distributing.

XDWE - equal weight world quality stocks (XDEQ for world quality stocks)

XWQS - ESG quality stocks

JGRE - Enhanced ESG quality stocks

SWLD - MSCI World (similar to SWDA). VHVG is Vanguard equiv.

HMWO - World (similar to SWDA)

XDEV - World developed or PQVG - usually higher return than SWDA but higher risk

I prefer XDEQ.

NASDAQ

EQQQ - NASDAQ 100 with dividends

XNAQ - NASDAQ 100

usually better than S&P - e.g. VUAG (Vanguard S&P500)

Tech

IITU - S&P Info technology (no Amazon)

IUCM - S&P Communication (no Amazon)

XLKQ - US Technology (limited <20% per company) - synthetic not physical stocks. V similar stocks to IITU but better slightly gain

Emerging Markets

EMSM - Emerging, small caps

EMVL - Emerging Value

DEMS - Emerging markets with high dividend (Acc)

Dividend paying ETFs

Japan

IJPH - Japan Hedged

Financials

BNKS - US banks

XUFB - US Banks Distributing (2-3% yield)

XWFS - Global financial

Energy

Suggested Active Fund

Non-Magnificent 7/IT stocks highlighted below...

No comments:

Post a Comment