Steve's blog about RMPrepUSB, Easy2Boot and USB booting and sometimes other stuff too! Don't forget to Subscribe! PDF eBooks here

Visit www.rmprepusb.com for over 140 Tutorials on USB booting or www.easy2boot.xyz for a unique USB multiboot solution.

Monday, 16 December 2024

Should I buy this ETF due to the forthcoming ban on TikTok?

Thursday, 12 December 2024

How to prepare for a stock market crash

Wednesday, 11 December 2024

ETFs for AI, Robotics and CyberSecurity

ETFs

Thursday, 5 December 2024

Is now a good time to buy UK FTSE shares?

The FTSE 100 index stands just 15% higher than its level of 31 December 1999, representing a compound annual gain of barely 0.5% per annum.

UK investors, insurance companies and pension companies have started to see the light and are leaving UK stocks for the shinier US market. A few UK companies are even starting to de-list from the FTSE and move over to the New York/NASDAQ stock exchanges.

However, if you discount the USA's 'Magnificent Seven', the UK has still performed quite well. Good UK companies are well diversified and pay good dividends. The UK also has some solid top performers as shown below (gains in 1 year):

- RR Rolls Royce 67%

- NWG NatWest Group 63%

- SMDS Smith(DS) Group 51%

- HL Hargreaves Lansdown 49%

- BARC Barclays 48%

Wednesday, 4 December 2024

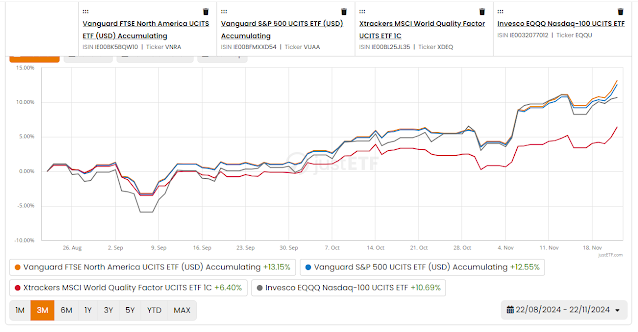

Which core ETF should I pick?

Many people like to have a core+satellite approach with their portfolio.

A popular choice for a core ETF is either:

- MSCI global index ETF (SWDA or HMWO)

- MSCI global Quality index ETF (XDEQ)

- S&P 500 index ETF (VUAA or VNRA or CSPX)

Tuesday, 26 November 2024

ETFs better than EQQQ or S&P 500 in Q4 2024!

Amazon does not feature much in high-performance Tech and Comms ETFs such as IITU or IUCM and comprises only 5% within the Nasdaq EQQQ ETF.

Some Consumer Discretionary ETFs hold a large proportion of Amazon (30%) and also Tesla (15%) such as XUCD (or XSCD for GBP). If you think Amazon and Tesla will do well next year when Trump takes over, this may continue to show good gains. I think Amazon will continue to show good performance next year although import tariffs and tightening advertising regulations in the EU and UK may adversely affect the Amazon online retail business.

Note: The ETF IUCD is very similar to XUCD and is available on Trading 212.

|

| Consumer Discretionary (blue) has shown good gains recently, mainly due to Tesla (and Amazon). |

Sunday, 24 November 2024

Top stock tips (2024/11/24)

Are Tech stocks safe?

Thursday, 14 November 2024

How to invest in Crypto?

The VanEck Crypto and Blockchain Innovators UCITS ETF seeks to track the MVIS Global Digital Assets Equity index. The MVIS Global Digital Assets Equity index tracks companies from around the world that are active in the blockchain industry.The ETF's TER (total expense ratio) amounts to 0.65% p.a.. The VanEck Crypto and Blockchain Innovators UCITS ETF is the only ETF that tracks the MVIS Global Digital Assets Equity index. The ETF replicates the performance of the underlying index by full replication (buying all the index constituents). The dividends in the ETF are accumulated and reinvested in the ETF.The VanEck Crypto and Blockchain Innovators UCITS ETF has 233m GBP assets under management. The ETF was launched on 30 April 2021 and is domiciled in Ireland.

I have added a few ETFs below from Justetf.com. The 'Trump effect' around Nov 4th is easy to see:

Wednesday, 13 November 2024

Trump Trades (stocks to buy now)

Trump stocks sectors that should show good performance in next 2 years are (with example ETFs):

- Crypto - e.g. DAPP, BLKC, CRYPTO

- Finance - e.g. IUFS

- Industry (esp. Tech and Tesla) - e.g. IUSU, IITU or XLKQ, IUCM

- Oil/Energy - e.g. IESU

- Defense - e.g. DFNS

- S&P 500 and Nasdaq - e.g. EQQQ, HSPA

Personally, of these, I am just investing in only some of them: EQQQ, IUFS, IUSU, IITU, IUCM and also some IESU (2%).

Friday, 8 November 2024

The Trump effect (and what should I buy now?)

- SWDA MSCI Global ETF

- XDEQ World Quality Factor ETF (may change to XDEM soon as includes financials)

- Royal London Global Equity

- XLKQ Xtrackers MSCI World Quality ETF (better perf. at 46% than SWDA 26%, XDEQ 25%, EQQQ 30%, XDEM 31% in last year!)

- IITU iShares S&P 500 Info Tech Sect ETF GBP

- IUCM iShares S&P 500 Comm Sect ETF USD

- IUFS iShares S&P 500 Financial ETF USD

- EQQQ Invesco NASDAQ 100 (I will be increasing this soon)

Monday, 21 October 2024

Should you keep your emergency 'cash pot' inside a Flexible ISA?

In the UK, we can put up to £20K into a tax-free ISAs each year and any capital gains are completely tax free.

Emergency cash pot

Many people (and particularly the self-employed) will have an emergency 'cash pot' which they can withdraw cash from should an emergency arise, such as if being unable to work due to accident or health, loss of job, unforeseen expenses, etc.

If you need to withdraw funds (e.g. due to temporary loss of income) it is best to withdraw from your emergency cash pot which typically holds at least 3-6 months of income rather than sell your high-gain stocks/ETFs and be out of the market.

Unless you are retired and are drawing a good pension, you may need an emergency pot that is large enough to support you for at least 6 months or so, especially if you don't have any other 'cash' resources.

This pot should not be invested in volatile assets because it needs to be available at all times - if you invested it in the S&P500 and the stock market went down 50% just when you needed the cash, you would only have half the emergency funds you thought you had!

When the s*it hits the fan...

Saturday, 19 October 2024

Should you pick a currency-hedged ETF if you don't live in the USA?

Currency-hedged ETFs are designed to protect investors from currency risk. They are a simple, cheap and effective way for small investors to access currency management techniques that were once the preserve of major financial institutions.

Currency risk affects you negatively when your home currency strengthens against a foreign currency – reducing the value of your assets held in that foreign currency. That means UK based investors are exposed to currency risk on all non-hedged ETFs that trade in overseas securities.

Currency-hedged ETFs are useful because they remove the uncertainty of exchange rate fluctuations. They sterilise your portfolio against the effect of currency so that your overseas investment doesn’t gain when the pound falls or lose when the pound rises.

Let us look at the US Dollar versus the GB Pound.

Wednesday, 16 October 2024

This Android phone tip may save you $THOUSANDS one day!

Thursday, 10 October 2024

Best long-term ETFs for UK investors (and retire with £3 million)!

Monday, 7 October 2024

Generate autounattend.xml files for Windows 10/11

Friday, 27 September 2024

My eBook sale was 'hacked'! (only 3 days left!)

Are Dividend ETFs performing better than other ETFs?

The last 6 months have been rather weak for Tech ETFs such as IITU and even Global tracker ETFs like the benchmark SWDA.

I see that dividend ETFs show better performance as well as paying dividends.

It expected that we will continue to see volatility during October/November 2024, so it may be better to switch some funds into dividend and value ETFs during this period.

The table below shows some of the best ETFs available in the UK and for comparison IITU and SWDA. Some Dividend ETFs are accumulating funds and some pay dividends.

A 6-month chart is shown below:

Thursday, 26 September 2024

Should I Buy Commodities ETFs?

Tuesday, 24 September 2024

Do you want to get free shares worth up to £100?

Do you want to get free shares worth up to £100 (£8-£100 randomly allocated)?

Join Trading 212, invest with my link and we will both get free shares.

https://www.trading212.com/invite/17tLB1ol6b

Trading 212 will pay 5.1% (UK) interest on cash in your T212 accounts, no monthly charge and no share buy/sell transaction charge (apart from Stamp Duty on UK company shares and Foreign Exchange charge of typ. 0.15% on non-GBP conversions). You can also get a debit card with your account to give you a debit card account paying 5.1% on your T212 balance (check spending/ATM withdrawal limitations).

Saturday, 21 September 2024

Stock market tip September 2024 (after Fed reserve rate cut 0.5%)

Tuesday, 17 September 2024

eBook SALE IS NOW ON (15%-25% off this week!)

Wednesday, 28 August 2024

Add DOS benchmarks to your Easy2Boot USB drive

Friday, 23 August 2024

How to prepare your investment portfolio for these volatile times

Amazon Prime bargains

Air Fryer

The unusual Schallen air fryer (#ad) is not only very cheap (just £30) but it is very easy to clean because the 'basket' is just a large Pyrex glass bowl.

Or you could up-scale to a large 5 litre Cosori (#ad) with Wi-Fi for about £70.

Tuesday, 20 August 2024

Is it time to buy Gold?

This year, Physical Gold has outperformed many global equity ETFs including my favourites SWDA and XDEQ. The gold ETF SGLN has shown a gain of 27.5% in one year. Over last 1, 3, 5 and 10 years it has kept pace with all world ETFs. Unlike bonds, gold can also dive when the market dives however.

This Q4 is expected to be volatile and the recent correction has scared some people but the market has now recovered. Investors are scared that a bigger correction may be coming before the end of 2024 and 2025 is also looking unsettled. 2025 is predicted to not be as good as the past two years have been. So some people are now turning to gold as a safer haven for their cash.

The graph below compares my favourite Physical Gold ETF (SGLN) to some other popular ETFs. Volatile Tech ETFs like tech ETFs XLKQ (40% gain this last year) or IITU have outperformed gold. China has a lot of secret gold (reputedly far more than they have declared) and if they need/want to sell some, they could devalue the dollar which would affect USA share prices. This would cause gold to increase in price as countries would want to increase their gold holdings to stabilise their own currency. Russia also hold a lot of gold and may need to sell some to support their Ukraine war.

Tuesday, 6 August 2024

Fix Ventoy UEFI Secure Boot not working on new PCs and Laptops

Secure Boot to grub/Ventoy/agFM/Linux, etc.

Saturday, 3 August 2024

No more Ventoy Secure Boot Issues - just use an IODD drive!

Monday, 22 July 2024

Simple hack to make sure Amazon deliver to you personally (no more 'drop and dash')!

Thursday, 11 July 2024

Steve's stock market top UK ETFs and tips (Q3 2024)

This article will be updated regularly. Visit every week for updates. Bookmark it now!

Charts/Info correct at 11 July 2024 (Justetf.com comparisons).

Updates

Blog page updated 15/7/24

Update 26/7/24 - Current Tech stocks correction, but 2024 Q4 S&P500 expected to do well in Q4. Wait for stocks to start rise again (may start today 26/7) and then BUY. May want to sell some in Q1 2025 if USA market volatile and buy more quality or world emerging market and small cap?

Update 5/8/2024 - Markets down 2-10% !! Mainly affected by USA - Fed failing to reduce interest rates and higher unemployment. Mostly however, companies are doing OK and the US market should recover after September. Probably too late to sell now, but get cash ready to invest in late Aug/Sept as soon as stocks start to plateau. UK\EU may be good as a hedge. Could consider selling some stock and buying CSH2 (money market 5.4%) but may miss recovery! I am not selling as expect bounce up when Fed finally cuts interest rate in Sept.

Update 13/8/2024 - Markets recovering to previous 3 months level. Market expecting Fed interest rate cut in Sept and better USA employment figures. If stocks dip today/tomorrow, maybe I will buy more.

Update 14/8/2024 - Best performing ETFs YearToDate, UICM 19% (US Comms), PQVG 21% (S&P QVM), IWFM 20% (World momentum), XDEM 20% (world momentum), IITU 22% (US Tech), XLKQ 25% (US Tech).

Update 16/8/2024 - Market recovered. Hot Tip: Buy TSLA now using ETF ICDU (Amazon 34%, Tesla 13%, Home Depot 8%). These companies may benefit from AI and also TSLA from sale of it's non-Chinese car software to all other global car companies that currently use Chinese OTA update software. Timeframe: 1 yr. BT group, Amazon, Alphabet and MSFT looking like strong buy (most except BT already in XLKQ ETF).

2024/8/27 - I bought FLXX sold some EMIM iShares Edge MSCI EM Value and all Japan.

Update 13/9/2024 - Market dipped but now recovering again! ICDU tipped last month is up almost 6% in one month. new tips are energy and finance sectors - e.g. IESU and IUFS for Mastercard\Visa. These are expected to do well within a 6 month time frame. For steady UK dividend stock try IUKD (5.8% in 3 months, 17% in 1 yr) which has beaten SWDA\XDEQ in last 1,3,6,12 months! Gold SGLN at all-time high, not a good time to buy - hold. I bought XLKQ 2024/9/4, XDEQ, SGLN and EQQQ 2024/9/10, IESU and IUFS 2024/9/13.

Update 21/9/2024 - Fed 0.5% rate cut happened which gave approx 1% rise to S&P. Smaller companies should now begin to do better as they will pay less interest on borrowings and can expand. The S&P600/small cap is a good bet now - e.g. ISP6 (2 divs/yr) or USSC (acc - heavier in financials which is good) or both as their top 10 don't overlap. Also Financials (WFEG or XLFQ or UIFS) and Energy (IESU - long term) seem good value.

Sunday, 16 June 2024

How to make at least £20K ($20K) for free!

This article mainly applies to UK residents but the general principle applies to most countries.

WARNING: If you have a non-state Pension, you may be being ripped off!

Reading this article can save you a lot of money! Someone may have robbed you of at least 20K and you don't even know it!

Sunday, 12 May 2024

agFM v1.A3 BUGFIX RELEASE - please update!

This bug affects anyone who uses .imgPTN* files that contain images of Windows Installers or WinPE images and they UEFI booting to agFM. Please update agFM.

v1.A3 2024-05-12 - bugfix - if you boot to agFM and Partition 1 has a XML or INI file in the root, agFM always permanently altered some of those files. This permanently changes the imgPTN image file contents if one has been swapped into Partition 1. The new version now only cleans these files if Partition 1 contains E2B files.

Sunday, 5 May 2024

How to improve your Ventoy USB drive!

Tuesday, 16 April 2024

HURRY - SPECIAL OFFER until May 1st - 3 months of Audible for 99p

Tuesday, 20 February 2024

Saturday, 17 February 2024

New 'Ventoy for E2B' v1.0.97 pre-release

Saturday, 10 February 2024

How to quickly display the amount of system Total RAM under Ventoy

Tuesday, 6 February 2024

E2B is the only SecureBoot multiboot solution which does not modify your UEFI BIOS!

These days, many PCs and Notebooks only have UEFI boot support.

If you wish to use a multiboot solution such as Ventoy, you must either disable Secure Boot (if you can get into the BIOS) or use Ventoy's MOK Manager shim to change the UEFI BIOS so that will accept the unsigned Ventoy EFI boot file (which then makes it insecure).

However, E2B allows us to switch in any partition image and boot to it. So as long as that image contains signed boot files (as in Windows or Ubuntu, etc.) then we can Secure Boot from that image.

I have added a page to the easy2boot.xyz website here in case you were not aware. There are many ways of supporting multiple Secure Boot images on an E2B USB drive and in this example I have used HBCD_PE as the secure OS. From HBCD_PE we can switch in any OS image file.

- Secure Boot to WinPE on the FAT32 Partition 3 of the E2B USB drive

- Switch into Partition 1 a new partition image file (e.g. Windows Install, Ubuntu, etc.)

- Secure Boot from the new image now in Partition 1, after this...

- Secure Boot to WinPE on the FAT32 Partition 3 of the USB drive

- Restore the original E2B Partition 1

Since we are booting from a FAT32 partition 1 on the USB drive, UEFI BIOSes should not have any compatibility issues. The Secure Boot boot files on the partition are unaltered and thus Secure Boot should always work even with the fussiest BIOSes!

Instead of HBCDPE, you can use any WinPE that supports 32-bit applications (has WoW64), such as Strelec or DLC or Bob Omb's WinPE.

Monday, 29 January 2024

Easy2Boot v2.20 released

v2.20 Change History

Sunday, 28 January 2024

A useful Windows System Information Utility for system repair, etc. (also runs under WinPE)

Add Tetris.EFI to Easy2Boot or Ventoy

A1ive (the author of grubfm) has a UEFI project which allows you to UEFI64-boot and play Tetris.

You can Download the tetris.efi file

and add it to your E2B (e.g. \_ISO\MAINMENU folder) or Ventoy USB drive.

Then UEFI-boot to agFM or Ventoy and select the tetris.efi file to play Tetris.