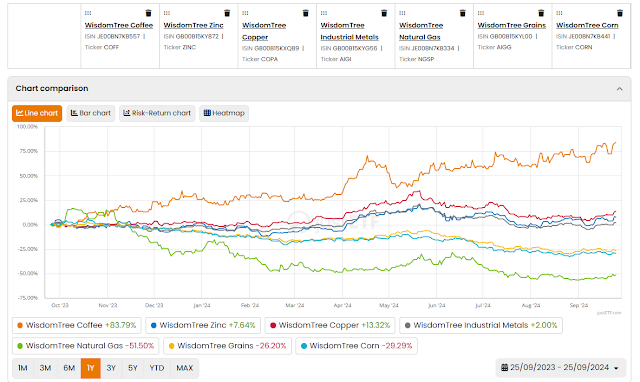

Wisdom Tree have many ETFs which allow you to 'gamble' on the futures price of some commodities such as Coffee (COFF) which has shown 100% gain in this last year.

The WisdomTree Coffee seeks to track the Bloomberg Coffee index. The Bloomberg Coffee index tracks the price of futures contracts on coffee.The ETC's TER (total expense ratio) amounts to 0.49% p.a.. The WisdomTree Coffee is the only ETC that tracks the Bloomberg Coffee index. The ETC replicates the performance of the underlying index synthetically with a swap.The WisdomTree Coffee is a small ETC with 30m GBP assets under management. The ETC was launched on 27 September 2006 and is domiciled in Jersey.

Below are a few others I have compared using the excellent JustEtf website...

A three-month chart shows that your Coffee is still strong ( ;-) !) with a 14% gain in 3 months!

Unless you know the commodities market well (which I don't), I would not advise you to gamble more than you can afford to lose on the commodities market, however with Winter approaching the northern hemisphere now, coffee and copper seem to be doing well. Natural gas is suffering from oversupply and weak demand due to a previous mild winter and large amounts in storage. The 2024/25 Winter is also expected to be slightly warmer than average for the USA (UK may have cold snap in late 2024).

With copper, sales of EV motors are slow at the moment, but wind turbine demand and electrical grid infrastructure improvements should boost future copper demand.

Warning: Commodities depend on politics and global events, so shares can be prone to extreme volatility.

Good luck,

Steve

Update Dec 9 2024: COFF did little until around Nov 9 2024 and is now up 30% at Dec 9 2024! Unfortunately I sold my shares in October as they were not moving.

I am not a financial advisor and this is not financial advice. I am just a guy on the internet. Please do your own research and make sure you understand what you are doing!

No comments:

Post a Comment