I am often asked by family and friends what they should invest in. This is an extremely difficult question because I don't want to be disowned by them if they lose their money!

Stock and Shares investment is a long term commitment.

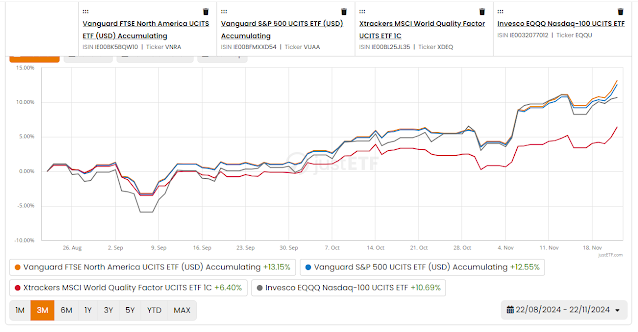

They can go up-diddly-up-up or down-diddly-down-down!

Be prepared - in some years your investment pot may decrease a lot in value but don't sell!

If you can't stand to see your portfolio lose 20% in a year, then you could choose a nice safe savings account instead! However, savings accounts barely keep up with inflation. If you are a high rate tax payer and put £100K into a savings account paying 5%, then in the UK each year you will pay 40% of that 5K interest to the tax man! If cashing out after 5 years, due to loss of compounding and the tax difference, you will be about £5K better off with a 5% gain ETF even if in a taxable S&S account, than in a 5% savings account.

When investing in Stocks and Shares we must consider:

- Is an income required (Accumulating or Dividend portfolio)?

- Tax laws in your country of residence and using them to your best advantage

- Attitude to risk and loss (would you mind if your portfolio went down 40% in a year?)

- Do you need access to the money within a few years - e.g. to buy a house or car?