Whether you have purchased my ebook 'How to make $1000 a month from the Internet' and made some money from a side hustle for very little initial cost or you have some savings sitting in a bank account which is earning a paltry 0.7% interest at best (or 0.01% as some banks like Barclays and NatWest are offering - wow - thanks guys!) - why not invest it in stocks and shares?

Even if your savings are earning 2% a year, you are losing money when you take inflation and the rising cost of living into account!

Due to the Ukraine crisis, now is a perfect time to invest in the stock market as prices are low.

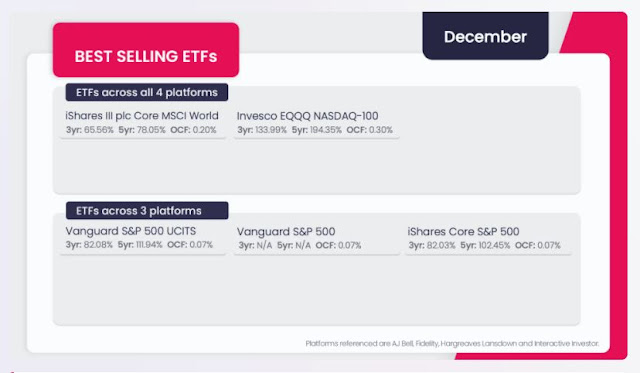

ETF screener to help you pick the right ones for you out of the 1000+ available.

I recommend a USA or Global ETF. For instance the SWDA ETF currently at 5925p (top global companies only) charges 0.2% annually and has almost tripled in value in 10 years (+75% in last 5 years). Quite a difference from the bank rate, isn't it?

As with all shares, the trick is to buy low.

So now is a perfect time to buy, before people realise that Ukraine has minimal effect on world or US economies (just maybe Europe) and stock prices will then start to recover. I wouldn't recommend a Europe ETF just now but the top 100 UK companies may be worth a side bet (e.g. CSUK)...

|

| iShares Core MSCI World = SWDA |

ETFs when bought within a Stocks and Shares ISA are even better as you don't pay tax on any gains (max of 20K a year - ISAs are a UK thing if you are from across the water similar to Roth IRA). Do some research on YouTube about ETFs and start now, you won't regret it.

Some ETFs accumulate (dividend payments are re-invested) and some (such as IWRD - Dist) will pay you a monthly or quarterly dividend if you want a small dividend income from them (e.g. 1-4%). Actively managed ETFs are not as popular as tracker ETFs due to their higher charges and generally erratic/poor performance - tracker ETFs are the most popular and they charge much less too.

ETFs also allow you to easily switch your strategy, for instance if something like a pandemic or a war seems likely, a gold ETF (e.g. SGLN) will usually perform better (up 40% in last 3 years) whereas an index tracker ETF would suffer. This allows you to easily change your mix of ETFs and some people trade ETFs like this rather than just hold the same index tracker ETF(s) for many years (i.e. buy and hold). For most people (including me) we just buy and hold as we can't beat the professional market traders at their own game.

It is very easy and quick to open an S&S ISA or regular dealing account with a reputable dealer such as Hargreaves and Lansdown or Interactive Investor (there are many others - check the costs first!) and then invest in an ETF.

Stock market prices will be shaky this week, but as you can see from the graph above, even a pandemic can't stop the trend upwards!

In the UK, the first 12,300 GBP of annual gain (profit) is free of Capital Gains tax (or pay no tax even if gains are over 12.3k if you use an ISA).

Disclaimer: This is not personal financial advice, do your own research and decide for yourself. Do not invest in ETFs unless you can afford to lose say 30% in a year (though wait a few years and it should recover). All I can say is that after having only just about broken even after 20 years of individual stock picking, I have done very well from investing in ETFs in the last 6 years. So the trick is to just invest in 100s of stocks by using a single ETF (or maybe two or three - e.g. 20% in SPDR Gold commodity ETF as a hedge) because their overall value always goes up over 3-5 years! i.e. Just follow the market. If they went down over 3-5 years then the world would be bankrupt and 'they' (governments/financiers/banks) are not going to let that happen, are they?

P.S. When this article was posted 24/2/2022, SWDA was at 5925p, on 23/3 it was 6385p (up 7.7% in less than 1 month).

No comments:

Post a Comment