Steve's blog about RMPrepUSB, Easy2Boot and USB booting and sometimes other stuff too! Don't forget to Subscribe! PDF eBooks here

Visit www.rmprepusb.com for over 140 Tutorials on USB booting or www.easy2boot.xyz for a unique USB multiboot solution.

Saturday, 11 January 2025

At last, no more Trading 212 'scam' videos!

Friday, 10 January 2025

What are the UK equivalents of the USA ETFs like VOO, SPY, VTI, VT, QQQ, VTV, SCHD, etc.?

ETFs like VOO (Vanguard S&P 500 ETF) and SCHD (Schwab U.S. Dividend Equity ETF) are not available on UK broker platforms such as Trading 212, Interactive Investor, etc.

You may have seen YouTube videos which recommend these ETFs.

Here are some equivalents which are usually available to UK and non-USA citizens.

Whole market Funds

VT & VTWAX

Monday, 6 January 2025

Debugging grub2 menus that won't fully boot (e.g. ArchLinux ISOs)

and here is the grub2 menu that was used...

menuentry "Arch Linux with Parameters" {set iso_path="/_ISO/LINUX/archlinux-2024.12.01-x86_64.iso"search --no-floppy -f --set=root $iso_pathprobe -u $root --set=archiso_img_dev_uuidloopback loop $iso_pathlsechols (loop)/echols /echols /_ISO/LINUX/echoecho archiso_img_dev_uuid=${archiso_img_dev_uuid} iso_path=${iso_path} root=${root}readlinux (loop)/arch/boot/x86_64/vmlinuz-linux archisobasedir=arch img_dev=UUID=${archiso_img_dev_uuid} img_loop=${iso_path}initrd (loop)/arch/boot/x86_64/initramfs-linux.imgread}

This menu sets iso_path to the path of the ISO file we wish to boot.

Monday, 16 December 2024

Should I buy this ETF due to the forthcoming ban on TikTok?

Thursday, 12 December 2024

How to prepare for a stock market crash

Wednesday, 11 December 2024

ETFs for AI, Robotics and CyberSecurity

ETFs

Thursday, 5 December 2024

Is now a good time to buy UK FTSE shares?

The FTSE 100 index stands just 15% higher than its level of 31 December 1999, representing a compound annual gain of barely 0.5% per annum.

UK investors, insurance companies and pension companies have started to see the light and are leaving UK stocks for the shinier US market. A few UK companies are even starting to de-list from the FTSE and move over to the New York/NASDAQ stock exchanges.

However, if you discount the USA's 'Magnificent Seven', the UK has still performed quite well. Good UK companies are well diversified and pay good dividends. The UK also has some solid top performers as shown below (gains in 1 year):

- RR Rolls Royce 67%

- NWG NatWest Group 63%

- SMDS Smith(DS) Group 51%

- HL Hargreaves Lansdown 49%

- BARC Barclays 48%

Wednesday, 4 December 2024

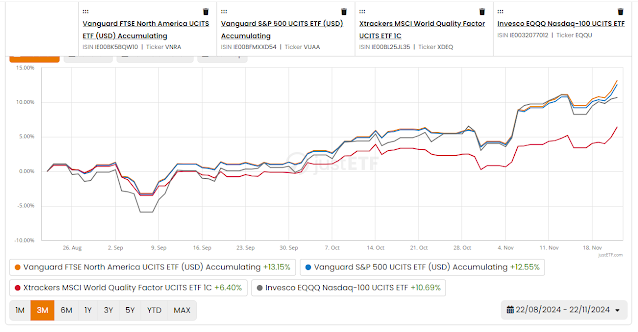

Which core ETF should I pick?

Many people like to have a core+satellite approach with their portfolio.

A popular choice for a core ETF is either:

- MSCI global index ETF (SWDA or HMWO)

- MSCI global Quality index ETF (XDEQ)

- S&P 500 index ETF (VUAA or VNRA or CSPX)

Tuesday, 26 November 2024

ETFs better than EQQQ or S&P 500 in Q4 2024!

Amazon does not feature much in high-performance Tech and Comms ETFs such as IITU or IUCM and comprises only 5% within the Nasdaq EQQQ ETF.

Some Consumer Discretionary ETFs hold a large proportion of Amazon (30%) and also Tesla (15%) such as XUCD (or XSCD for GBP). If you think Amazon and Tesla will do well next year when Trump takes over, this may continue to show good gains. I think Amazon will continue to show good performance next year although import tariffs and tightening advertising regulations in the EU and UK may adversely affect the Amazon online retail business.

Note: The ETF IUCD is very similar to XUCD and is available on Trading 212.

|

| Consumer Discretionary (blue) has shown good gains recently, mainly due to Tesla (and Amazon). |