Steve's blog about RMPrepUSB, Easy2Boot and USB booting and sometimes other stuff too! Don't forget to Subscribe! PDF eBooks here

Visit www.rmprepusb.com for over 140 Tutorials on USB booting or www.easy2boot.xyz for a unique USB multiboot solution.

Sunday, 24 November 2024

Top stock tips (2024/11/24)

Thursday, 14 November 2024

How to invest in Crypto?

The VanEck Crypto and Blockchain Innovators UCITS ETF seeks to track the MVIS Global Digital Assets Equity index. The MVIS Global Digital Assets Equity index tracks companies from around the world that are active in the blockchain industry.The ETF's TER (total expense ratio) amounts to 0.65% p.a.. The VanEck Crypto and Blockchain Innovators UCITS ETF is the only ETF that tracks the MVIS Global Digital Assets Equity index. The ETF replicates the performance of the underlying index by full replication (buying all the index constituents). The dividends in the ETF are accumulated and reinvested in the ETF.The VanEck Crypto and Blockchain Innovators UCITS ETF has 233m GBP assets under management. The ETF was launched on 30 April 2021 and is domiciled in Ireland.

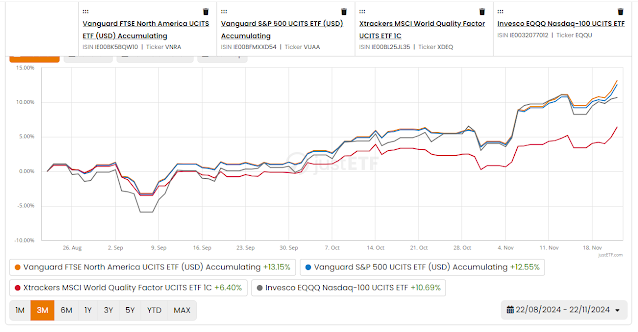

I have added a few ETFs below from Justetf.com. The 'Trump effect' around Nov 4th is easy to see:

Wednesday, 13 November 2024

Trump Trades (stocks to buy now)

Trump stocks sectors that should show good performance in next 2 years are (with example ETFs):

- Crypto - e.g. DAPP, BLKC, CRYPTO

- Finance - e.g. IUFS

- Industry (esp. Tech and Tesla) - e.g. IUSU, IITU or XLKQ, IUCM

- Oil/Energy - e.g. IESU

- Defense - e.g. DFNS

- S&P 500 and Nasdaq - e.g. EQQQ, HSPA

Personally, of these, I am just investing in only some of them: EQQQ, IUFS, IUSU, IITU, IUCM and also some IESU (2%).

Friday, 8 November 2024

The Trump effect (and what should I buy now?)

- SWDA MSCI Global ETF

- XDEQ World Quality Factor ETF (may change to XDEM soon as includes financials)

- Royal London Global Equity

- XLKQ Xtrackers MSCI World Quality ETF (better perf. at 46% than SWDA 26%, XDEQ 25%, EQQQ 30%, XDEM 31% in last year!)

- IITU iShares S&P 500 Info Tech Sect ETF GBP

- IUCM iShares S&P 500 Comm Sect ETF USD

- IUFS iShares S&P 500 Financial ETF USD

- EQQQ Invesco NASDAQ 100 (I will be increasing this soon)

Monday, 21 October 2024

Should you keep your emergency 'cash pot' inside a Flexible ISA?

In the UK, we can put up to £20K into a tax-free ISAs each year and any capital gains are completely tax free.

Emergency cash pot

Many people (and particularly the self-employed) will have an emergency 'cash pot' which they can withdraw cash from should an emergency arise, such as if being unable to work due to accident or health, loss of job, unforeseen expenses, etc.

If you need to withdraw funds (e.g. due to temporary loss of income) it is best to withdraw from your emergency cash pot which typically holds at least 3-6 months of income rather than sell your high-gain stocks/ETFs and be out of the market.

Unless you are retired and are drawing a good pension, you may need an emergency pot that is large enough to support you for at least 6 months or so, especially if you don't have any other 'cash' resources.

This pot should not be invested in volatile assets because it needs to be available at all times - if you invested it in the S&P500 and the stock market went down 50% just when you needed the cash, you would only have half the emergency funds you thought you had!

When the s*it hits the fan...

Saturday, 19 October 2024

Should you pick a currency-hedged ETF if you don't live in the USA?

Currency-hedged ETFs are designed to protect investors from currency risk. They are a simple, cheap and effective way for small investors to access currency management techniques that were once the preserve of major financial institutions.

Currency risk affects you negatively when your home currency strengthens against a foreign currency – reducing the value of your assets held in that foreign currency. That means UK based investors are exposed to currency risk on all non-hedged ETFs that trade in overseas securities.

Currency-hedged ETFs are useful because they remove the uncertainty of exchange rate fluctuations. They sterilise your portfolio against the effect of currency so that your overseas investment doesn’t gain when the pound falls or lose when the pound rises.

Let us look at the US Dollar versus the GB Pound.