Many people are tempted to trade in the cryptocurrency sector.

You could just buy some crypto currency such as Bitcoin or Ethereum from a broker such a Coinbase (COIN) or CRYPTO for Bitcoin. You need to also bear in mind that any crystallised gains made on a sell transaction of cryptocurrency may be a taxable event (e.g. Capital Gains Tax in the UK) and should be declared. Coinbase will inform HMRC of any large crypto inflows (I think around £5k+/yr going into crypto assets).

Many people invest in MicroStrategy (Nasdaq:MSTR) which loosely follows Bitcoin's performance (though you would be hard pressed to know what it does from the description!). MSTR uses investors money to buy Bitcoin and they will own approx. 4% of all Bitcoins soon. However, the share price has gained x4 more this year than Bitcoin has! It seems mad to me! It can be bought inside a ISA or SIPP unlike bitcoins or Ethereum, and so is popular with crypto investors.

There is also LON:ARB and Coinbase (COIN):

Another alternative is to buy a crypto ETF such as VanEck Crypto and Blockchain Innovators UCITS ETF (DAPP/DAGB). This can be bought within an ISA and thus gains are free of all tax.

The VanEck Crypto and Blockchain Innovators UCITS ETF seeks to track the MVIS Global Digital Assets Equity index. The MVIS Global Digital Assets Equity index tracks companies from around the world that are active in the blockchain industry.

The ETF's TER (total expense ratio) amounts to 0.65% p.a.. The VanEck Crypto and Blockchain Innovators UCITS ETF is the only ETF that tracks the MVIS Global Digital Assets Equity index. The ETF replicates the performance of the underlying index by full replication (buying all the index constituents). The dividends in the ETF are accumulated and reinvested in the ETF.

The VanEck Crypto and Blockchain Innovators UCITS ETF has 233m GBP assets under management. The ETF was launched on 30 April 2021 and is domiciled in Ireland.

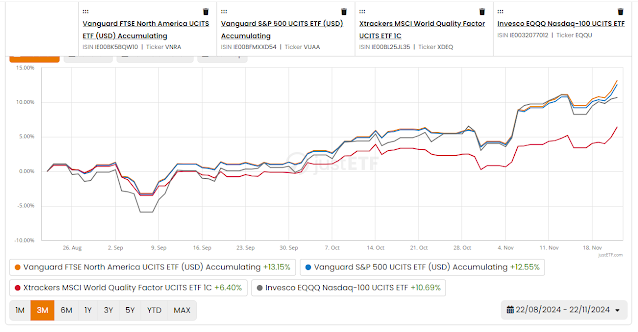

I have added a few ETFs below from Justetf.com. The 'Trump effect' around Nov 4th is easy to see: